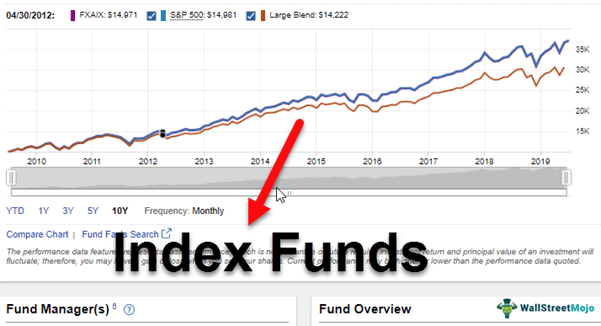

Index Funds Meaning These stocks don t necessarily need to be the exact stocks in the S P 500 index the objective is simply to mimic the index s characteristics rather than purchase every stock in the index Fund managers like the stratified sampling approach because it s easier faster and usually involve fewer transactions than fully replicating an index

The percentage of each stock is market cap weighted just like the index meaning the greater the market cap of the company the greater the percentage of the fund that company represents As companies are added or subtracted from the S P 500 index this fund will follow suit and purchase or sell shares to stay in line with the index Exchange traded funds have grown increasingly popular in recent years and the number of offerings has swelled Today these securities compete with mutual funds and offer a number of advantages over their predecessors including Low Cost Unlike traditional mutual and index funds ETFs have no front or back end loads

Index Funds Meaning

Index Funds Meaning

https://www.finideas.com/wp-content/uploads/2020/07/Equity-vs-Index-3-1.png

What Is Index Fund Meaning Capital

https://img.capital.com/imgs/glossary/600x300x1/93-Index-funds.jpg

Index Funds Meaning Explanation Examples Advantages

https://www.wallstreetmojo.com/wp-content/uploads/2019/08/Index-Funds-2.png

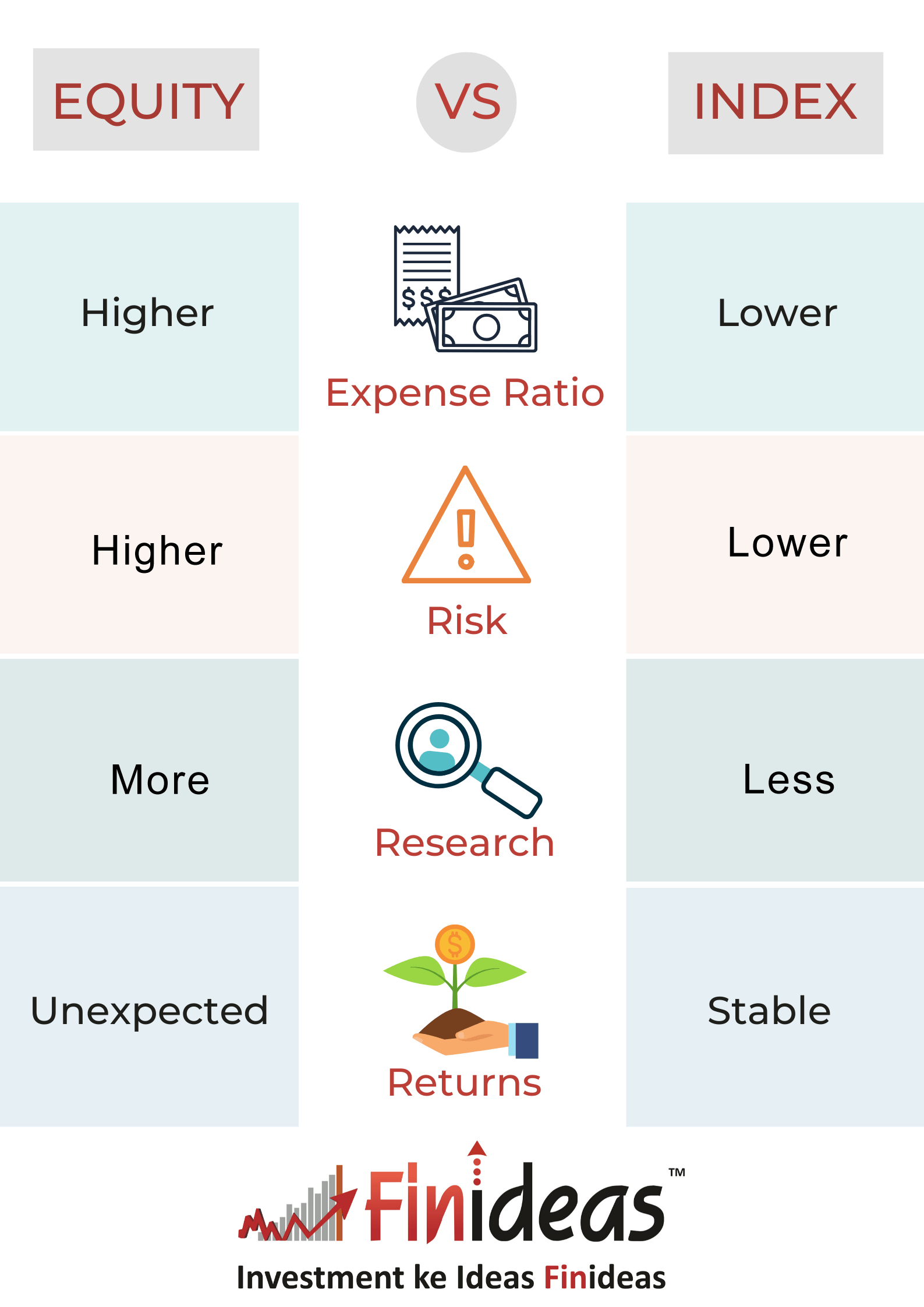

Sector funds which invest in specific stock groups often within one industry Index funds which invest in the same or similar stocks as equity market indices like the S P 500 International funds which invest in foreign stocks Why Equity Funds Matter One of the greatest advantages of equity funds is instant diversification For example the iShares Dow Jones Select Dividend Index Fund is an ETF that invests in the 100 stocks contained in the Dow Jones U S Select Dividend Index ETF shares are essentially legal claims to underlying shares held in a trust by the fund s creator or authorized participant which is usually a market maker specialist or institutional

Funds must also present one year five year and 10 year annualized returns as well Income investors also should consider their investment horizon Short term funds which typically invest in bonds maturing in one to five years typically offer lower yields than intermediate term funds which invest in bonds maturing in five to 10 years Exchange traded funds ETFs are securities that closely resemble index funds but can be bought and sold during the day just like common stocks Essentially iShares offer the convenience of a stock along with the diversification of a mutual fund However exchange traded funds don t sell shares directly to investors

More picture related to Index Funds Meaning

Best Etfs For 2025 Uk Xena Carrissa

https://alphalyticscm.com/wp-content/uploads/2021/06/Types-of-ETFs-graphic.png

Index Funds Meaning Examples Benefits Differences

https://financeplusinsurance.com/wp-content/uploads/Index-Funds-Meaning-What-Is-an-Index-Fund-Example-of-Index-Funds-Index-Funds-vs.-Actively-Managed-Funds-Benefits-Advantages-of-Index-Mutual-Funds-Investing-FinancePlusInsurance-1.webp

What Is An Index Fund Personal Finance Club

https://i1.wp.com/www.personalfinanceclub.com/wp-content/uploads/2020/07/2020-07-14-What-is-an-index-fund.png?fit=1080%2C1080&ssl=1

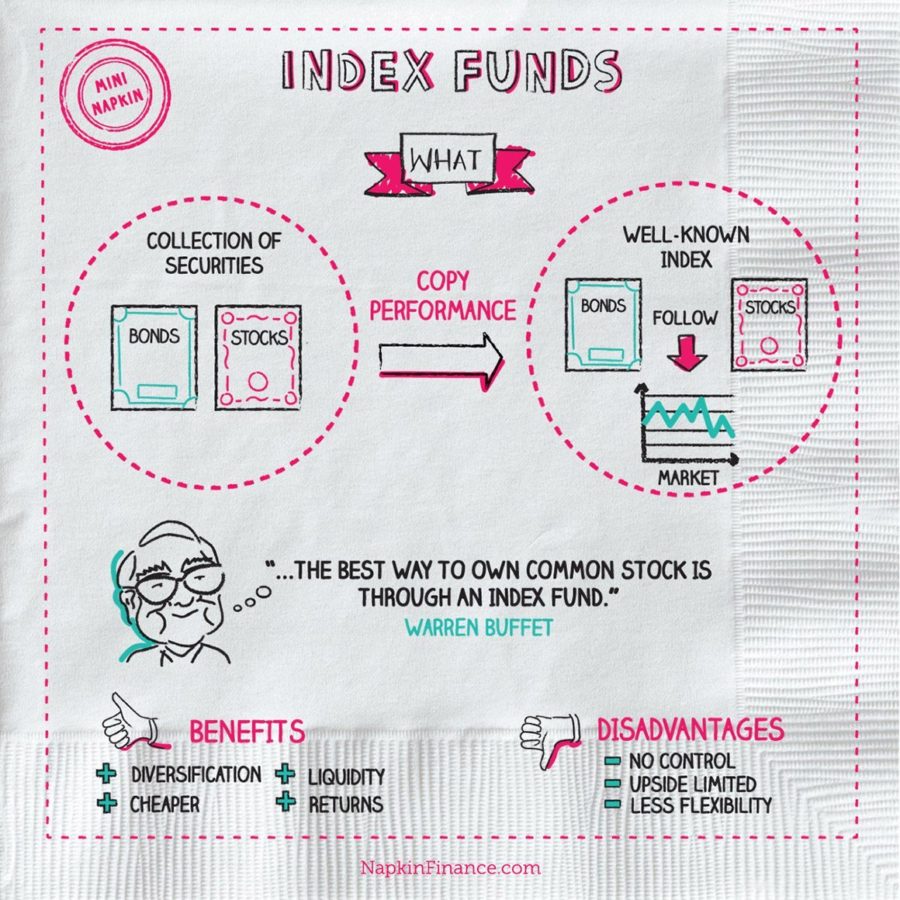

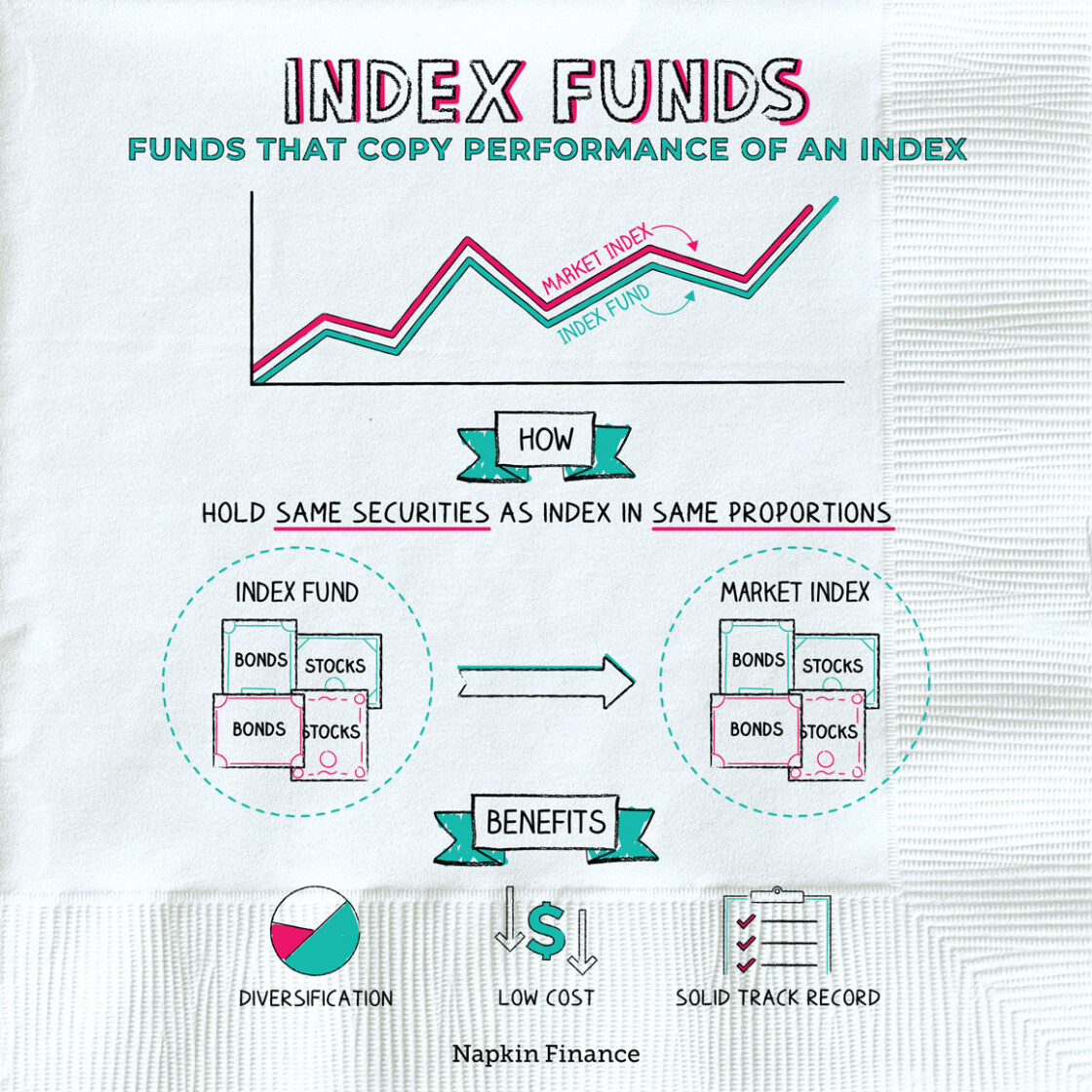

Like all foreign funds the dollar s fluctuations have an impact on the fund s value Remember a weak dollar means that the stocks you hold which are valued in foreign currencies will command more dollars when they are sold A weak dollar is good for dollar based foreign investors Why Does the EAFE Index Matter This could be stocks or bonds as there are indices for both For example an S P 500 index fund will hold the companies that are part of the S P 500 Index Index funds are known for having very low fees as they are passively managed Popular options include S P 500 index funds total stock market index funds or total international stock

[desc-10] [desc-11]

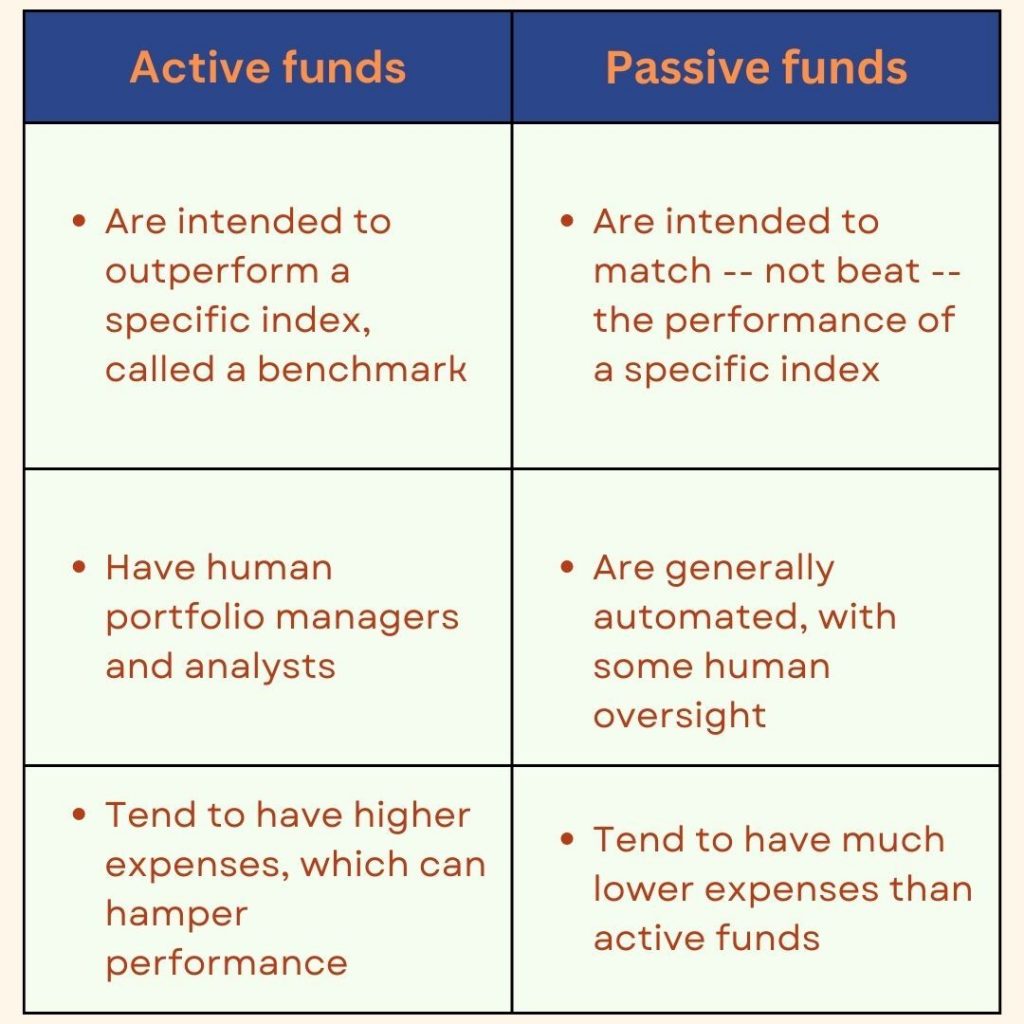

Active Vs Passive Funds Explained MProfit

https://wp.mprofit.in/wp-content/uploads/2023/04/active-vs-passive-investing-1024x1024.jpg

Active Vs Passive Funds Explained MProfit

https://wp.mprofit.in/wp-content/uploads/2023/04/active-vs-passive-investing-768x768.jpg

https://investinganswers.com › dictionary › stratified-sampling-approach

These stocks don t necessarily need to be the exact stocks in the S P 500 index the objective is simply to mimic the index s characteristics rather than purchase every stock in the index Fund managers like the stratified sampling approach because it s easier faster and usually involve fewer transactions than fully replicating an index

https://investinganswers.com › dictionary › mutual-fund

The percentage of each stock is market cap weighted just like the index meaning the greater the market cap of the company the greater the percentage of the fund that company represents As companies are added or subtracted from the S P 500 index this fund will follow suit and purchase or sell shares to stay in line with the index

Introduction To Investment Concepts Johan Du Toit

Active Vs Passive Funds Explained MProfit

What Is Index Fund Meaning Capital

Types Of Index Funds

Best Dividend Index Funds 2024 Reyna Harriet

Best Index Funds 2024 Reddit India Davina Carlene

Best Index Funds 2024 Reddit India Davina Carlene

What Is An Index Fund The Motley Fool

:max_bytes(150000):strip_icc()/index-funds-vs-etfs-2466395_V22-d288a73d28154c3c9df884f076f2f6af.png)

ETF Vs Index Fund Which Is Right For You

Mutual Funds Vs Hedge Funds What s The Difference Bsevarsity

Index Funds Meaning - For example the iShares Dow Jones Select Dividend Index Fund is an ETF that invests in the 100 stocks contained in the Dow Jones U S Select Dividend Index ETF shares are essentially legal claims to underlying shares held in a trust by the fund s creator or authorized participant which is usually a market maker specialist or institutional